It is pretty much entirely driven by the demand side of the equation, and since Bitcoin is not linked to any real-world value, the demand side is almost entirely the result of market sentiment. The supply side does not really have a strong impact on the volatility of Bitcoin. Supply growth is currently always positive and small and, in the future, will steadily decrease down to zero. Why is Bitcoin so otherworldly volatile?īitcoin has a very clear and predefined monetary policy. As such, they also answer the question, what would have happened in a worst-case scenario, if an investor bought at the absolute peak and sold at the absolute trough. They tell you about price declines versus previous peaks and tell the story of the frequency and the magnitude of price corrections. Any investment that has the potential to perform phenomenally is nearly bound to also exhibit frightening levels of risk.ĭrawdown charts are pessimistic charts in the sense that they only focus on the downside. There almost always is a strong relationship between risk and reward.

#BITCOIN MAXIMUM DRAWDOWN FREE#

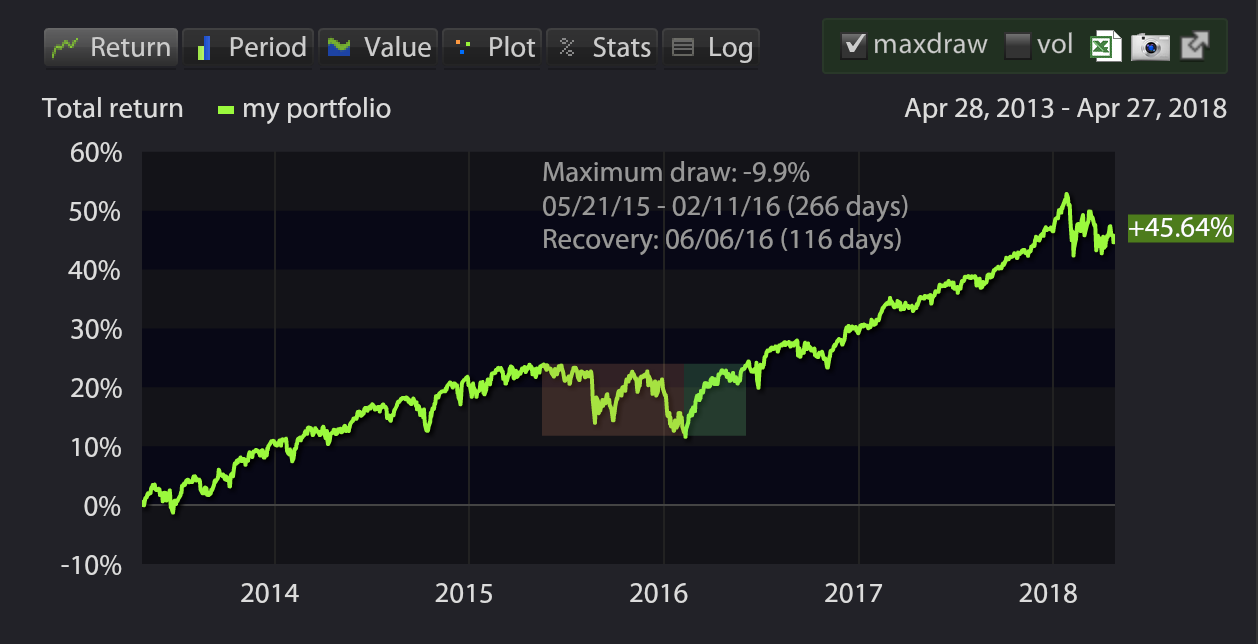

The key takeaway is that Bitcoin has not only shown an extremely high return profile, but has done so with very high levels of risk and substantial temporary drawdowns, once again driving home the message “there is no free lunch”. While the recent decrease is certainly eye-opening in dollar terms, historically speaking, it is not special in percentage terms. As of, Bitcoin’s current max drawdown stands at roughly 30.5%. Of course, equities have also not exhibited the compound annual growth rate of Bitcoins during the last 12 years, or in any 12-year time frame during the last century. Equities have exhibited such a drawdown only once during the entire last century, after the peak of 1929 which coincided with the start of the Great Depression. On three occasions, or roughly every four years, the most prominent of crypto assets experienced a peak to trough retreat of 75% or more. While many individuals are aware of the recent massive drop in the value of Bitcoin and other crypto assets and the incident in 2018, it is important to remember that this was ‘not the only rodeo’ that Bitcoin went through in its more than 12-year history.

0 kommentar(er)

0 kommentar(er)